原帖由 slwong3 於 2008-9-30 07:48 AM 發表

from the news that I have heard, their 七千億方案 has been added some new conditions and is agreeded by both parties. They are waiting for the parties members to vote and the earliest they can finish ...

原帖由 slwong3 於 2008-9-30 07:48 AM 發表

from the news that I have heard, their 七千億方案 has been added some new conditions and is agreeded by both parties. They are waiting for the parties members to vote and the earliest they can finish ...

哩班人真係無乜資格出來同人說教

哩班人真係無乜資格出來同人說教

原帖由 Triangel 於 2008-9-30 12:55 PM 發表

A sian Markets fall on U.S. bailout failure

updated 1 hour, 14 minutes ago

不會吧

不會吧

原帖由 LU 於 2008-9-30 09:49 PM 發表

我老豆同我講話..........美國國會唔通過議案, 係因為美國啲人好多都爭銀行好多卡數, e+ 宜得間銀行早啲摺埋, 咁佢哋就可以唔使還卡數有無人咁狗架 ...

原帖由 Lee3 於 2008-9-30 11:37 PM 發表

不是卡數而是房屋貸款,沒有錢還就要被銀行售樓。但是銀行不是說突然閒會不做,他們只是被別的銀行收購,譬如washinton mutual, 破產,聯邦政府收購,轉手給jp morgan chase, 美國政府一定要保障國民的銀行戶口,所以是轉售而 ...

原帖由 Lee3 於 2008-10-1 05:34 AM 發表

共 和 黨 議 員 Paul Ryan 就 說 得 坦 白 : 「 選 民 有 很 強 烈 意 見 , 我 也 擔 心 會 失 業 。 」

很多人不明白他在説什麽,美國議會的蟬聯率是99%,基本上如果你沒有死掉,你就可以當選。 ...

原帖由 Triangel 於 2008-10-2 09:48 AM 發表

The Senate has approved a modified $700 billion financial rescue plan just two days after a vote failed in the House.

原帖由 Lee3 於 2008-10-3 12:14 AM 發表

the new bill and the old bill are the same, sure there's a little more coverage, like from 100,000 to 250,000 and a little more tax cuts to the normal people, but the money still comes from the trea ...

原帖由 Triangel 於 2008-10-3 04:50 AM 發表

Dow falls 348 as investors worry that the House won't approve the $700B plan.

"There's still concern about whether or not the House will pass the bill and even if they do, whether it will be effective ...

原帖由 Lee3 於 2008-10-3 05:48 AM 發表

and there is NOTHING on returning the money. Hence the biggest problem. Notice that everyone the report quotes work at high managerial positions. The bailout is intended to give these fkfaces a lot ...

.

.

原帖由 Triangel 於 2008-10-3 06:27 AM 發表

I can't agree more with your point;

However, nobody on earth has such a big bullet that can halt the crisis except from US Government.

AIG has vanished, and so do many of the banks next ...

原帖由 Triangel 於 2008-10-4 02:24 AM 發表

$700B bailout passes

President Bush poised to quickly sign historic $700 billion plan into law.

Woman, 90, shoots self inside foreclosed home

.... telling her story. "This bill fails to a ...

原帖由 Lee3 於 2008-10-4 04:10 AM 發表

That is the root inherent problem OF THIS BILL. THIS IS WHY IT WAS IT WAS BLOCKED IN THE FIRST PLACE.

THE GOVERNMENT IS OUT TO DESTROY ALL NORMAL AMERICANS, BOTH MCCAIN AND OBAMA APPROVED OF IT. A ...

原帖由 Triangel 於 2008-10-4 02:24 AM 發表

$700B bailout passes

President Bush poised to quickly sign historic $700 billion plan into law.

Woman, 90, shoots self inside foreclosed home

.... telling her story. "This bill fails to a ...

原帖由 Triangel 於 2008-10-5 12:19 AM 發表 [url=redirect.php?goto=findpost&pid=2882565&ptid=191349][/url]

Fannie Mae forgives loan for woman who shot herself

"We'regoing to forgive whatever outstanding balance she had on the loan andgive her the house," Faith said. "Given the circumstances, we think i...

原帖由 Triangel 於 2008-10-6 10:07 PM 發表

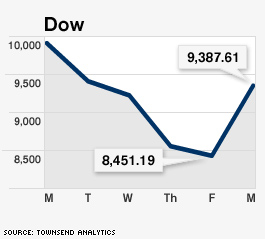

Dow plummets more than 300 points, falling below 10,000 for the first time in nearly 4 years, as anxiety over global slowdown grows.

Analysts doubt $700 billion bailout will be enough to avert ...

原帖由 Triangel 於 2008-10-8 03:22 AM 發表

Bush: 'We're going to come through'

President reassures citizens, says government actions will prevent a painful and deep recession.

...

| HSI: | 15,431.730 | -1,372.03 |

貝爾說,

貝爾說,

原帖由 Triangel 於 2008-10-9 05:43 AM 發表

七大央行減息救全球

野村證券駐倫敦利率策略部主管貝爾說,

多國央行聯手減息,

反映他們終於明白信貸危機的嚴重性 ,

此舉已令主要長期利率回落,

有助 ...

原帖由 Lee3 於 2008-10-9 10:56 AM 發表

其實這一次的災難已經還好了。爲什麽這樣說?因爲我們有即時通訊,全世界的市場可以同步救市。那些大集團可以立刻抽離,普通市民也同樣可以即時抽離。早20年,每一個人都要打電話過去wall st, 如果這是在20年前,絕對是the s ...

原帖由 Triangel 於 2008-10-9 11:19 AM 發表

其實這一次的災難已經還好了。爲什麽這樣說?因爲我們有即時通訊,全世界的市場可以同步救市。那些大集團可以立刻抽離,普通市民也同樣可以即時抽離。早20年,每一個人都要打電話過去wall st, 如果這是在20年前,絕對是the s ...

原帖由 Triangel 於 2008-10-10 03:41 AM 發表

Dow falls about 300 points pulling it below 9,000 -- its lowest intraday level since July 1, 2003.

What the Fed has done is eventually going to help turn things around, but people don't believe it ye ...

原帖由 Triangel 於 2008-10-13 10:08 PM 發表

Stocks soar on rescue plans

Dow rallies 400 points as investors cheered the global response to the crisis.

The Treasury Department this morning outlined how it will move forward with the $700 billion ...

| DOW j 9,042.90 | +591.71 / +7.00% |

授 , 在 耶 魯 大 學 畢 業 、 麻 省 理 工 學 院 拿 博 士 學 位 , 是 薩 繆 爾 森 ( Paul Samuelson ) 和 索 羅 ( Robert Solow ) 的 愛 將 , 屬 新 凱 恩 斯 學 派 , 主 張 自 由 貿 易 , 卻 不 反 對 政 府 干 預 , 政 見 傾 向 自 由 派 , 關 心 政 府 政 策 對 貧 富 差 距 的 影 響 。

授 , 在 耶 魯 大 學 畢 業 、 麻 省 理 工 學 院 拿 博 士 學 位 , 是 薩 繆 爾 森 ( Paul Samuelson ) 和 索 羅 ( Robert Solow ) 的 愛 將 , 屬 新 凱 恩 斯 學 派 , 主 張 自 由 貿 易 , 卻 不 反 對 政 府 干 預 , 政 見 傾 向 自 由 派 , 關 心 政 府 政 策 對 貧 富 差 距 的 影 響 。 過 譽 , 尤 其 是 東 南 亞 國 家 的 經 常 賬 赤 字 高 企 , 早 晚 會 出 現 危 機 。 三 年 後 的 亞 洲 金 融 風 暴 印 證 他 的 預 言 , 技 驚 四 座 , 成 為 經 濟 學 大 紅 人 。 對 於 這 場 金 融 海 嘯 , 克 魯 明 也 有 很 多 意 見 , 指 喬 治 布 殊 放 寬 監 管 華 爾 街 和 財 政 政 策 太 寬 鬆 是 成 因 之 一 , 今 年 3 月 預 測 美 國 樓 市 平 均 要 跌 25% , 樓 市 之 後 又 果 然 崩 圍 。

過 譽 , 尤 其 是 東 南 亞 國 家 的 經 常 賬 赤 字 高 企 , 早 晚 會 出 現 危 機 。 三 年 後 的 亞 洲 金 融 風 暴 印 證 他 的 預 言 , 技 驚 四 座 , 成 為 經 濟 學 大 紅 人 。 對 於 這 場 金 融 海 嘯 , 克 魯 明 也 有 很 多 意 見 , 指 喬 治 布 殊 放 寬 監 管 華 爾 街 和 財 政 政 策 太 寬 鬆 是 成 因 之 一 , 今 年 3 月 預 測 美 國 樓 市 平 均 要 跌 25% , 樓 市 之 後 又 果 然 崩 圍 。 原帖由 Triangel 於 2009-3-4 02:40 AM 發表

60 people get jobs today from stimulus package today.

Good Job Pres Obama

we have 3,500,000 - 6 = 3,499,994 Job position to be filled....

| 歡迎光臨 娛樂滿紛 26FUN (http://www.26fun.com/bbs/) | Powered by Discuz! 7.0.0 |